Learn how accounting services in India streamline finances, taxes, and...

How Australian Companies Augment Their IT Team in India?

November 13, 2024

What Makes the ODC Model the Future of Global IT Outsourcing?

November 15, 2024The Ultimate Guide to Payroll Outsourcing Services in India

Did you know that businesses spend an average of 18% of their time on payroll tasks each month? Managing payroll in-house can be both costly and time-consuming, especially for small to mid-sized businesses that lack dedicated payroll expertise. That’s why many companies are turning to payroll outsourcing services in India—a solution offering expert payroll management, significant cost savings, and enhanced compliance. If you’re considering outsourcing payroll for your business, this guide will provide everything you need to know about payroll outsourcing in India.

Table of Content

ShowHide- The Ultimate Guide to Payroll Outsourcing Services in India

- What Is Payroll Outsourcing?

- Why Choose Payroll Outsourcing Services in India?

- Benefits of Payroll Outsourcing in India

- How to Choose the Right Payroll Outsourcing Company

- Common Payroll Outsourcing Services

- FAQs About Payroll Outsourcing Services in India

- Key Takeaways for Payroll Outsourcing in India

- Conclusion

- Top 10 Office Infrastructure Setup Trends for 2025

- How to Find Top IT Staff Augmentation Services for Melbourne

- Top 5 IT Staff Augmentation Companies in India in 2025

What Is Payroll Outsourcing?

Payroll outsourcing is the process of hiring an external provider to manage and execute payroll functions. This includes calculating employee wages, tax deductions, filing returns, and ensuring compliance with labor laws and regulations. By engaging a payroll service provider, businesses can eliminate the hassle and costs of in-house payroll management and benefit from specialized resources.

Why It Matters:

Payroll errors or compliance issues can lead to hefty penalties and strained employee relations. With payroll outsourcing, companies can ensure payroll accuracy and stay compliant with regional labor laws.

Why Choose Payroll Outsourcing Services in India?

India has become a global leader in payroll services due to its large pool of skilled professionals, cost-effective solutions, and advanced technological infrastructure. Let’s explore the unique advantages India offers in payroll outsourcing:

- Lower Costs: Operating costs for payroll services in India are significantly lower than in Western countries.

- High Quality of Service: Indian payroll companies employ skilled professionals who ensure accuracy and compliance.

- Time Zone Advantage: Indian providers can process payroll overnight for companies in the US, UK, and Australia, enabling uninterrupted business functions.

- Technological Expertise: Indian payroll companies leverage the latest technology and software for payroll management, ensuring efficiency and data security.

Benefits of Payroll Outsourcing in India

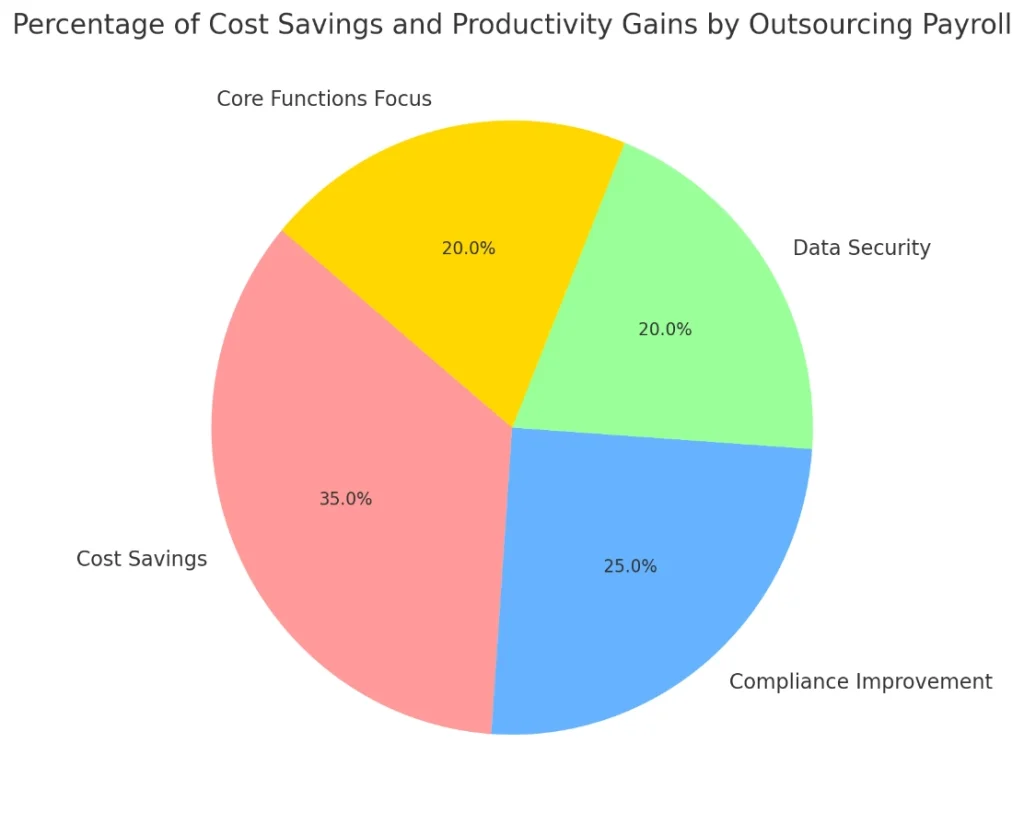

- Cost Savings

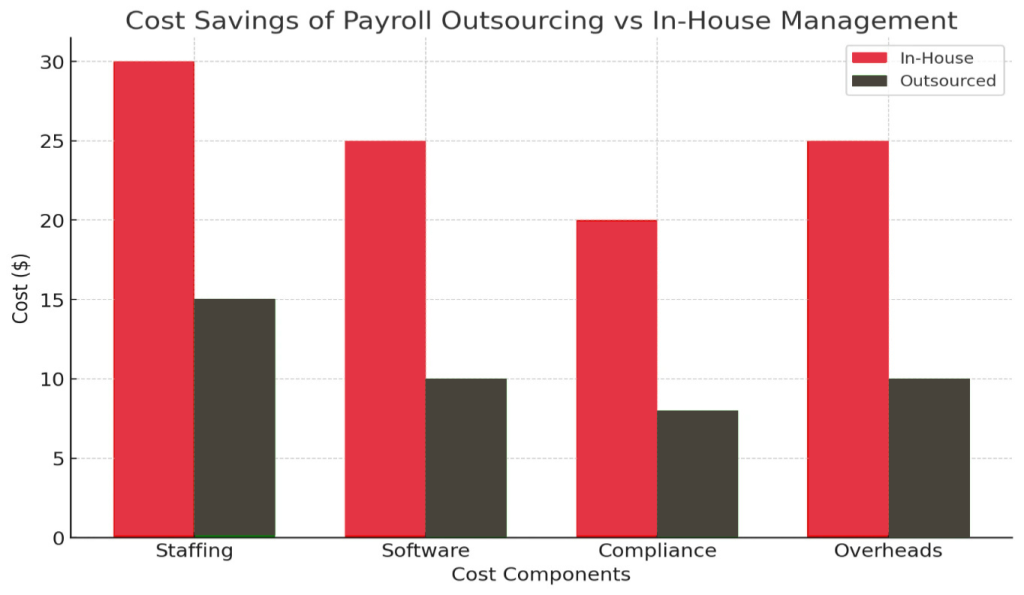

Outsourcing payroll to India can substantially reduce costs associated with staffing, training, and maintaining payroll software. By only paying for the services you need, you avoid unnecessary overhead expenses. - Enhanced Compliance

Indian payroll providers are proficient in local and international compliance standards, ensuring companies stay within legal bounds and avoid fines. - Improved Data Security

Indian outsourcing companies heavily invest in cybersecurity, protecting sensitive payroll data against threats. Many companies have advanced encryption and regular audits to ensure data protection. - Focus on Core Business Functions

Outsourcing payroll frees up valuable time and resources, allowing companies to focus on strategic objectives rather than time-consuming administrative tasks. - Scalability

Indian payroll services offer flexible solutions that grow with your business, whether expanding to new regions or scaling down operations.

How to Choose the Right Payroll Outsourcing Company

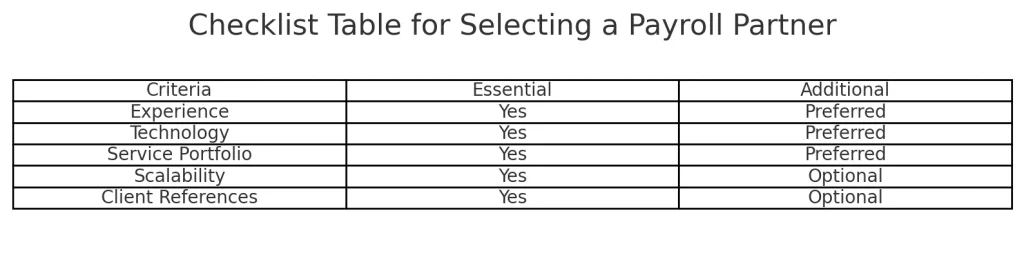

When selecting a payroll outsourcing partner, carefully evaluate potential providers based on the following criteria:

- Experience and Expertise: Choose a provider with demonstrated experience in payroll management and industry-specific expertise. This is especially critical for companies in sectors with unique payroll needs.

- Technology and Security Measures: Ensure the provider utilizes secure, up-to-date software and adheres to high data protection standards. Ask about data encryption, compliance audits, and cybersecurity protocols.

- Service Portfolio: Look for comprehensive payroll management services that cover payroll processing, compliance support, and tax filing.

- Scalability: Select a provider capable of adapting to your evolving needs, whether you’re scaling up or down.

- Client References and Reviews: Request client references or explore online reviews to gauge the provider’s reputation and reliability.

Common Payroll Outsourcing Services

Here’s an overview of the key services typically provided by payroll outsourcing companies:

- Payroll Calculation and Processing: Accurate wage calculation, bonuses, deductions, and overtime.

- Tax Filing and Compliance: Managing federal, state, and local tax requirements to prevent penalties.

- Reporting: Monthly or quarterly payroll cost and compliance reports.

- Employee Self-Service Portals: Enabling employees to access payslips, tax forms, and other essential documents online.

- Leave and Benefits Management: Overseeing leave entitlements, benefits, and reimbursements.

FAQs About Payroll Outsourcing Services in India

- Is payroll outsourcing cost-effective?

Yes. By eliminating the need for internal payroll infrastructure and expertise, outsourcing reduces expenses by 20-30%. - Are payroll outsourcing services secure?

Yes. Indian payroll outsourcing companies follow stringent security protocols to protect sensitive data. - How quickly can payroll outsourcing be implemented?

Implementation typically takes a few weeks to a month, depending on company size. - Will outsourcing affect my control over payroll processes?

No, you retain control over data and can customize services according to business needs.

Key Takeaways for Payroll Outsourcing in India

- Cost-Effective: Saves up to 30% in payroll processing costs.

- Efficient and Accurate: Minimizes errors and improves compliance.

- Time-Saving: Allows companies to focus on core business goals.

- Secure: Uses advanced cybersecurity to protect sensitive data

Conclusion

Outsourcing payroll can be a transformative choice for businesses, offering cost savings, expertise in compliance, and efficient payroll management. With India’s reputation for delivering high-quality payroll services, companies can confidently choose an Indian provider to enhance operations and reduce costs.

Recent Post

Step-by-Step Guide to Setting Up Accounting Services in India for Your Business

Explore the step-by-step process of setting up accounting services in...

Offshore Development Centre for UAE Businesses | iValuePlus

Explore how UAE businesses can scale faster with an Offshore...